Managing Accounts for Growth With Bookkeeping пфеуюшщ

Effective management of accounts is essential for business growth. Accurate bookkeeping serves as the backbone of this process, enabling organizations to track financial health and make informed decisions. Key practices in bookkeeping can significantly influence resource allocation and operational efficiency. By integrating technology, businesses can streamline their financial management. Understanding how to analyze financial data can reveal critical insights. The implications of these strategies are profound, prompting further exploration into their potential benefits.

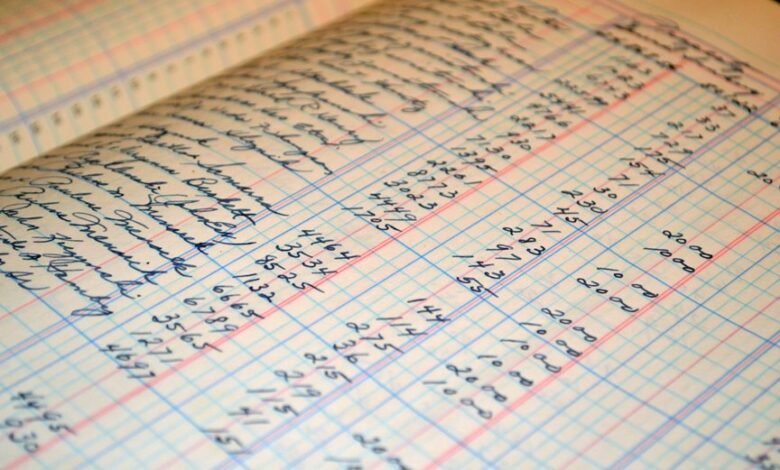

Understanding the Importance of Accurate Bookkeeping

Accurate bookkeeping is essential for any organization aiming to achieve sustainable growth, as it serves as the foundation for informed decision-making.

Financial accuracy ensures that resources are allocated efficiently, minimizing waste and maximizing potential.

The benefits of bookkeeping extend beyond compliance; they empower organizations to identify trends, forecast needs, and make strategic choices, ultimately fostering an environment conducive to innovation and freedom.

Key Bookkeeping Practices for Small Businesses

Implementing effective bookkeeping practices is crucial for small businesses striving to maintain financial health and facilitate growth.

Key practices include diligent cash flow management to ensure liquidity and timely expense tracking to identify cost-saving opportunities.

Regularly reviewing financial statements allows owners to make informed decisions, ultimately fostering a proactive approach to finances that can lead to sustainable growth and enhanced operational efficiency.

Utilizing Technology for Streamlined Financial Management

Leveraging technology can significantly enhance financial management processes for small businesses.

Cloud solutions facilitate real-time access to financial data, enabling informed decision-making.

Additionally, automation tools streamline repetitive tasks, reducing manual errors and freeing up valuable time.

Analyzing Financial Data to Drive Strategic Decisions

How can small businesses harness the power of financial data to inform their strategic decisions?

By employing financial forecasting techniques and utilizing data visualization tools, they can translate complex data sets into actionable insights.

This approach enables businesses to identify trends, assess performance, and make informed choices, ultimately fostering growth and enhancing their operational freedom in a competitive marketplace.

Conclusion

In conclusion, effective account management through diligent bookkeeping is essential for business growth. Research indicates that companies with organized financial records are 40% more likely to experience growth than those without. By implementing key bookkeeping practices and leveraging technology for real-time financial insights, businesses can uncover trends and make strategic decisions. This proactive approach not only enhances operational efficiency but also lays the groundwork for innovation, ultimately driving sustainable success in an increasingly competitive marketplace.